Category Menu

Prosidium Warranty & Capital is proud to announce the promotion of Becca Villegas to Chief Operating Officer, effective immediately. Becca originally joined the Prosidium team in 2024 as Director of OEM and INEOS Relations, bringing with her a sharp strategic mindset and a passion for delivering excellence in client service.

In a short time, Becca has made a profound impact—deepening OEM partnerships, enhancing client collaboration, and elevating the operational synergy between departments. Her ability to lead with clarity, support dealer initiatives, and leverage the Prosidium team’s collective strengths has made her an invaluable part of the organization’s growth and success.

“Becca exemplifies what it means to be a leader in today’s fast-paced and partnership-driven landscape,” said Mark Del Rosso, CEO of Prosidium. “Her operational instincts are outstanding, but it’s her ability to execute with precision and empathy that sets her apart. Promoting Becca to Chief Operating Officer is not only a reflection of her capabilities—it’s a strategic move that positions Prosidium for even greater impact.”

As COO, Becca will oversee day-to-day operations, drive cross-functional performance, and support the strategic execution of Prosidium’s core vision: helping our clients help their customers, and together we build trust.

To learn more about Becca’s background and her initial appointment to the Prosidium team, visit Prosidium Welcomes Becca Villegas.

About Prosidium Warranty & Capital

Prosidium Warranty & Capital, an international provider of automotive finance, insurance, and capital solutions. Since its founding in 2009, Prosidium has delivered innovative protection products, reinsurance opportunities, and strategic business support to Automotive, RV, and Powersports dealers. The company remains committed to helping dealers grow using trust, integrity, innovation, and exceptional service.

Prosidium Warranty & Capital, a leading provider of third-party warranty solutions, is pleased to announce the appointment of Tom Patterson as Chief Financial Officer (CFO). Patterson brings more than 15 years of executive experience in financial strategy, operational leadership, and data-driven decision-making. His expertise will be instrumental in advancing Prosidium’s financial and strategic objectives as the company continues to grow.

Patterson joins Prosidium from Protect My Car, where he served as Senior Vice President of Operations and Risk Management. In this role, he successfully led cross-functional teams, refined internal processes, and leveraged AI-driven data analytics to optimize financial performance. His leadership has been pivotal in driving profitability, improving customer retention, and mitigating financial risk. Prior to that, he held CFO and executive positions at several financial and operational firms, specializing in corporate finance, budgeting, and strategic execution.

As Patterson steps into the CFO role, Ed Barton, who has served as CFO of Prosidium, will transition into a newly established executive role, Chief of Staff, and will be reporting to CEO Mark Del Rosso. Barton has been instrumental in shaping the financial health of the company, and his continued leadership will ensure a seamless transition while driving operational efficiencies across the organization.

“We are excited to welcome Tom to the Prosidium team,” said Mark Del Rosso, CEO of Prosidium Warranty & Capital. “His deep financial expertise and strategic insight will be invaluable as we expand our product offerings and enhance operational efficiency. At the same time, we are grateful for Ed’s continued leadership as he shifts into a role that will further strengthen our operational capabilities.”

Patterson will oversee Prosidium’s financial planning, risk management, and growth initiatives, supporting the company’s mission to deliver innovative warranty solutions that build trust with dealers and their customers.

For more information about Prosidium Warranty & Capital, visit prosidiumusa.com

We are excited to announce that Denyn Pysz has joined Prosidium Warranty & Capital as the new Director of Business Development. With over 20 years of experience in the automotive industry and a diverse background in sales, service, and business strategy, Denyn brings unparalleled expertise and innovation to our team.

Denyn’s career includes key leadership roles such as Sales Director at Mach10 Automotive, where he guided clients in sales, service, and operations toward optimized performance and success. His experience at Dynatron Software and automotiveMastermind Inc. has further solidified his reputation as a dynamic sales leader with a proven ability to drive growth, build high-performing teams, and deliver outstanding results.

In his new role, Denyn will focus on developing and implementing strategic business initiatives that enhance dealership partnerships, increase market share, and drive revenue growth. His extensive expertise in CRM, SaaS, AI, and data mining will be instrumental in identifying and leveraging opportunities for innovation and expansion within Prosidium network.

Denyn’s dedication to fostering strong relationships, coupled with his passion for driving measurable results, aligns perfectly with Prosidium’s commitment to delivering exceptional value to our dealer partners and their customers.

Please join us in welcoming Denyn Pysz to the Prosidium family. We are excited about the vision, leadership, and expertise he brings to his new role, and we look forward to the impact he will have on our business development initiatives.

About Prosidium Warranty & Capital

Prosidium Warranty & Capital, with offices in Washington, Arizona, and Mexico City, is a leading international provider of Automotive finance, insurance, and capital solutions, offering innovative financial products and services to Automotive, RV, and Powersports Dealers. Founded in 2009 by Travis Coulter, PWC is committed to delivering high-quality service and value to its clients.

We are excited to announce that Brady Jones has joined Prosidium Warranty & Capital as the new US Executive Vice President of Dealer Success. With over 25 years of leadership experience in the automotive industry, Brady brings a proven track record in sales growth, strategic partnerships, and operational excellence.

Brady most recently served as Chief Operating Officer at Cilajet Aviation Grade, where he played a pivotal role in overseeing fantastic growth. His focus on sales strategy, agency relations, income development, and innovative program creation has earned him industry-wide recognition.

In his new role, Brady will lead Prosidium Warranty & Capital’s sales initiatives in the US automotive market, overseeing dealer partnerships, driving revenue growth, and developing innovative solutions tailored to dealership needs. His expertise in forging strong relationships with dealers, agencies, and key stakeholders will be essential in advancing Prosidium commitment to dealer success.

Brady’s leadership will play a crucial role in enhancing our strategic direction, strengthening our dealer relationships, and ensuring exceptional value delivery to our partners.

Please join us in welcoming Brady Jones to the Prosidium family. We are excited about the expertise, vision, and dedication he brings to this role, and we look forward to the positive impact he will have on our team and our partners.

Prosidium Warranty & Capital, with offices in Washington, Arizona, and Mexico City, is a leading international provider of Automotive finance, insurance, and capital solutions, offering innovative financial products and services to Automotive, RV, and Powersports Dealers. Founded in 2009 by Travis Coulter, Prosidium is committed to delivering high-quality service and value to its clients.

We are excited to announce that Becca Villegas has joined our PWC family as our new Executive Director – INEOS and OEM programs. Becca brings a wealth of experience with over 20 years in the automotive industry, including extensive expertise in OEM, retail operations, captive finance, and business analytics. Her proven track record in project management, strategic growth, and performance optimization will be instrumental as we continue to elevate our operations and partner engagement.

In her new role, Becca will take the lead in bringing the INEOS partnership to life, spearheading our corporate partnerships and account strategies. As Executive Director – INEOS and OEM programs, she will be responsible for guiding the strategy and execution related to corporate partnerships, with a focus on enhancing relationships with existing brand partners and driving new business opportunities, including partnerships with OEMs and lenders.

Becca’s role is pivotal in ensuring that we exceed partner and customer expectations while achieving our revenue growth targets. Her leadership will support our goal of building strong, mutually beneficial relationships with our brand partners, and her focus on effective team execution will help us continue to deliver outstanding results.

We are confident that Becca’s vision, expertise, and commitment to excellence will bring tremendous value to our organization. Please join me in giving her a warm welcome as she begins this exciting new chapter with PWC. We look forward to the positive impact she will have on our team and our partners.

About Prosidium Warranty & Capital

Prosidium Warranty & Capital (PWC), with offices in Washington, Arizona, and Mexico City, is a leading international provider of Automotive finance, insurance, and capital solutions, offering innovative financial products and services to Automotive, RV, and Powersports Dealers. Founded in 2009 by Travis Coulter, PWC is committed to delivering high-quality service and value to its clients.

Prosidium Warranty & Capital Announces Leadership Transition: Mark Del Rosso Appointed as New CEO and President

FOR IMMEDIATE RELEASE

Washington State – 10/11/2024 – Prosidium Warranty & Capital (PWC), a leading international provider of automotive finance and insurance (F&I) products and services is pleased to announce a significant leadership transition as part of the company’s long-term growth strategy. After 15 successful years of building and leading PWC, Founder and CEO Travis Coulter will assume the role of Executive Chairman, while Mark Del Rosso, former President of Audi America and CEO of Genesis Motors America, will take over as CEO and President.

This change marks a new chapter for Prosidium Warranty & Capital as the company continues to expand its market presence. As Chairman of the Board, Travis Coulter will remain actively involved in shaping the strategic direction of PWC, providing leadership, vision, and guidance to ensure the company remains at the forefront of innovation in the industry.

“It has been an incredible journey starting and then leading PWC over the last 15 years,” said Travis Coulter. “I am excited to continue contributing to the company’s growth and success in my new role as Chairman, while also welcoming Mark Del Rosso to lead the day-to-day operations. Mark’s extensive experience and leadership in the automotive industry make him the ideal person to guide PWC into its next phase of expansion.”

Mark Del Rosso, whose career spans leadership roles at Lexus, Toyota and Bentley, along with Audi America and Genesis Motors America, brings a wealth of experience in leading high-performance teams and driving operational excellence. His appointment is expected to accelerate PWC’s growth trajectory and strengthen the company’s position as a market leader.

“I am honored to join Prosidium Warranty & Capital at such a pivotal time in the company’s journey,” said Mark Del Rosso. “I look forward to working closely with Travis and the entire PWC team to drive the company’s continued success and build on its strong foundation of helping dealers help their clients.”

The leadership transition becomes effective October 15th. Both leaders are confident that this change will bring new energy and focus to the company’s mission of delivering exceptional service and value to its customers and partners.

For more information, please contact:

Prosidium Warranty & Capital

1-360-848-7922

Mark@pwcteam.com

Travis@pwcteam.com

www.prosidiumusa.com

About Prosidium Warranty & Capital

Prosidium Warranty & Capital (PWC), with offices in Washington, Arizona, and Mexico City, is a leading international provider of Automotive finance, insurance, and capital solutions, offering innovative financial products and services to Automotive, RV, and Powersports Dealers. Founded in 2009 by Travis Coulter, PWC is committed to delivering high-quality service and value to its clients.

When you invest in a luxury vehicle, you expect unparalleled performance, cutting-edge technology, and a driving experience like no other. However, even the most exceptional vehicles require protection from unexpected repair costs. That’s where Prosidium’s Luxury Care comes in—a premium extended warranty plan designed specifically for new and pre-owned luxury vehicles.

Comprehensive Coverage Options

Prosidium’s Luxury Care offers three distinct coverage plans—Powertrain Plus, Preferred, and Maximum—each tailored to meet the unique needs of luxury vehicle owners:

Powertrain Plus: This plan covers essential components such as the engine, transmission, drive axle, air conditioning, heating/cooling systems, and electrical components. It’s designed to protect the most critical parts of your vehicle, ensuring it remains in top condition.

Preferred: Building on the Powertrain Plus plan, the Preferred option also includes suspension components and fuel delivery systems. This plan is ideal for those who want an extra layer of protection for their luxury vehicle’s advanced systems.

Maximum: The ultimate in vehicle protection, the Maximum plan covers all parts of the vehicle, excluding only those listed under the exclusions in the agreement. This plan ensures that virtually every component of your luxury vehicle is protected, providing you with complete peace of mind.

Additional Benefits

Every Luxury Care plan comes with additional benefits to enhance your ownership experience:

- 24-Hour Roadside Assistance: Whether you need a tow, a flat tire changed, or an emergency gas delivery, help is just a phone call away.

- Substitute Transportation: If your vehicle is in the shop for covered repairs, you won’t be left stranded. Substitute transportation is provided, so you can continue your day without disruption.

- Trip Interruption Service: If your vehicle breaks down far from home, Luxury Care provides coverage for unexpected expenses such as lodging and meals while your car is being repaired.

Why Choose Luxury Care?

Owning a luxury vehicle is a significant investment, and protecting that investment is crucial. Prosidium’s Luxury Care not only extends the warranty on your vehicle but also offers the comprehensive coverage needed to ensure it remains in pristine condition. Whether you drive a Porsche, Bentley, or another high-end brand, Luxury Care is designed with your vehicle in mind.

With options for different levels of coverage and a range of additional benefits, Luxury Care offers you the flexibility to choose the protection that best suits your needs. Whether you’re concerned about major engine components or want complete vehicle coverage, there’s a plan for you.

Final Thoughts

Prosidium’s Luxury Care is more than just an extended warranty—it’s a commitment to protecting your investment in a luxury vehicle. With tailored plans that cover everything from essential components to the entire vehicle, you can drive with confidence knowing that your car is safeguarded against unexpected repair costs. Invest in Luxury Care today and enjoy the peace of mind that comes with knowing your vehicle is in the best possible hands.

At PWC, we believe in building a workplace where talent meets opportunity. Our dynamic environment fosters growth, innovation, and excellence across all levels of the organization. Whether you are an experienced professional or just starting out, PWC offers a wide range of career paths designed to help you achieve your professional goals.

Why Choose PWC?

PWC is not just a place to work; it’s a place to thrive. We are committed to creating an inclusive and diverse work environment where every team member feels valued and empowered to contribute their unique skills and perspectives. Our culture is built on the principles of integrity, collaboration, and continuous improvement, ensuring that we consistently deliver exceptional results for our clients.

Key Benefits of Working at PWC:

Professional Development: At PWC, we invest in your growth. We offer comprehensive training programs, mentorship opportunities, and access to industry-leading resources that will help you advance your career. Whether you’re looking to sharpen your existing skills or explore new areas of expertise, PWC provides the tools and support you need to succeed.

Innovative Work Environment: Innovation is at the heart of what we do. Our teams work on cutting-edge projects that challenge the status quo and push the boundaries of what’s possible. At PWC, you’ll have the opportunity to work with the latest technologies and methodologies, contributing to projects that make a real impact.

Work-Life Balance: We understand the importance of work-life balance and offer flexible work arrangements to help you manage your personal and professional responsibilities. At PWC, we believe that a healthy balance between work and life is essential for maintaining productivity and well-being.

Diverse Career Paths: PWC offers a wide range of career paths, from consulting and finance to technology and operations. Whether you’re interested in a client-facing role or prefer to work behind the scenes, there’s a place for you at PWC. We encourage internal mobility and provide opportunities for cross-functional learning and development.

Commitment to Community: We are dedicated to giving back to the communities in which we operate. PWC’s corporate social responsibility initiatives allow employees to participate in volunteer activities, charitable events, and other community-driven projects. By working at PWC, you’ll have the chance to make a positive impact both inside and outside the office.

Join the PWC Team

Are you ready to take the next step in your career? At PWC, we are always looking for talented, motivated individuals to join our team. Whether you’re a seasoned professional or a recent graduate, PWC offers a variety of career opportunities that will help you reach your full potential.

Explore our current job openings and learn more about what it’s like to work at PWC by visiting our careers page. We invite you to apply and discover how PWC can be the next step in your professional journey.

Visit our careers page to learn more and apply today: PWC Careers

At PWC, your career is our priority. Join us and be part of a team that values innovation, collaboration, and excellence.

As a dealership, offering customers added protection for their vehicles is a critical component of delivering exceptional service and building long-term trust. Prosidium’s Total Care plan provides an opportunity for dealerships to enhance their product offerings by including a comprehensive protection package that covers a wide array of potential vehicle issues.

Why Dealerships Should Offer Total Care

Enhanced Customer Satisfaction: By offering Total Care, you give your customers peace of mind, knowing their vehicles are protected from everyday road hazards. This includes coverage for tire and wheel damage, cosmetic wheel repairs, paintless dent repair, windshield repair, and key replacement. These coverages address common issues that can disrupt vehicle ownership, making your dealership’s offerings more appealing.

Increased Revenue Streams: Total Care provides an additional revenue opportunity for dealerships. By bundling this protection plan with vehicle sales, you can offer a value-added service that customers are willing to pay for, thus increasing your overall profitability.

Differentiation in the Market: In a competitive marketplace, standing out is essential. Offering a comprehensive protection plan like Total Care can differentiate your dealership from others, showing your commitment to customer care even after the sale is complete.

Customer Retention: A satisfied customer is more likely to return for future purchases. With Total Care, you’re not just selling a vehicle; you’re selling ongoing protection and service. This fosters customer loyalty, leading to repeat business and referrals.

Comprehensive Protection: Total Care covers a range of issues that could arise from everyday driving, such as road hazard tire damage, dents, and windshield cracks. This ensures that your customers’ vehicles remain in showroom condition, enhancing their overall satisfaction with their purchase.

Key Features of Total Care

- Tire & Wheel Protection: Covers damage from potholes, nails, and other road debris.

- Cosmetic Wheel Repair: Includes repairs for scrapes and scratches, with replacement if needed.

- Paintless Dent Repair: Covers minor dents and dings, including hail damage.

- Windshield Repair/Replacement: Covers cracks, stars, and chips caused by road hazards.

- Key Replacement: Provides coverage for lost, stolen, or damaged keys, including lock-out service and towing assistance.

Conclusion

Prosidium’s Total Care plan offers dealerships a robust tool to enhance customer satisfaction, increase revenue, and build lasting relationships. By integrating this comprehensive protection plan into your offerings, you’re not only protecting your customers’ vehicles but also protecting your dealership’s reputation and bottom line.

With the back-to-school season upon us, it’s essential to ensure your vehicle is prepared for the increased demands that come with it. From early morning drop-offs to after-school activities, your car will likely see more use than usual. Now is the perfect time to give it the attention it deserves to keep it running smoothly.

Why Vehicle Readiness Matters

As the school year begins, your daily routine becomes busier, which means your vehicle will play a critical role in ensuring everything runs smoothly. The last thing you need is unexpected vehicle issues disrupting your schedule. Regular maintenance checks can help prevent common problems like brake wear, tire tread issues, and battery failures that often arise with frequent use.

Check Your Limited Warranty Coverage

One of the most important aspects of preparing your vehicle for the back-to-school season is ensuring your limited warranty coverage is up-to-date. Knowing that your vehicle is protected against unexpected repairs offers peace of mind. If your warranty is about to expire, consider investing in an extended warranty to cover essential components. This added protection can save you from costly repairs and ensure your vehicle stays reliable throughout the school year.

Maintenance Tips for a Smooth School Year

Brake Inspection: Your brakes are crucial, especially with the stop-and-go traffic that comes with school runs. Ensure they are in good condition to avoid any safety hazards.

Tire Check: Inspect your tires for wear and tear. Proper tire maintenance not only extends the life of your tires but also improves fuel efficiency and safety.

Battery Health: With increased usage, your car’s battery may drain faster. Have it tested to ensure it’s holding a charge and won’t leave you stranded.

Fluids Top-Up: Check all essential fluids, including engine oil, coolant, and windshield washer fluid, to keep your vehicle running smoothly.

Lights and Signals: Ensure all lights and turn signals are functioning correctly to maintain visibility and safety on the road.

Extend Your Protection

If your vehicle’s warranty is nearing its end or doesn’t cover all the components you’re concerned about, now might be the perfect time to consider an extended warranty. This extra layer of protection can be a lifesaver, covering repairs that can arise as your car ages and sees more use during the school year.

Final Thoughts

Getting your vehicle ready for the back-to-school season is about more than just convenience; it’s about ensuring the safety and reliability of your transportation. By checking your warranty coverage and performing regular maintenance, you can avoid unexpected issues and focus on what matters most—getting your family where they need to be safely and on time.

In the competitive landscape of automotive sales, finding effective strategies to finance more deals can significantly impact your dealership’s success. Here are four actionable tips that can help your dealership secure more financing deals and ultimately drive sales growth.

1. Educate and Empower Your Sales Team

Your sales team is the frontline of your dealership. Ensuring they are well-versed in all aspects of financing can make a substantial difference. Providing regular training sessions on the latest financing options, loan terms, and credit assessment procedures will empower your sales team to confidently discuss financing with potential buyers.

Key Strategies:

- Regular Training: Implement a structured training program that keeps your team updated on new financing products, changes in lending criteria, and effective sales techniques. Sign your team up for our PRO F&I Certification Course today!

- Role-Playing Scenarios: Use role-playing exercises to help salespeople practice discussing financing options with customers. This can improve their confidence and communication skills.

- Incentive Programs: Motivate your team with incentives for successfully closing financed deals. Recognizing and rewarding their efforts can drive better performance.

2. Enhance Customer Experience with Personalized Financing Solutions

Today’s consumers expect personalized service. Offering tailored financing solutions based on individual customer needs can enhance their buying experience and increase the likelihood of closing a deal.

Key Strategies:

- Comprehensive Needs Assessment: Conduct thorough assessments to understand each customer’s financial situation and preferences. This allows you to recommend the most suitable financing options.

- Flexible Financing Options: Partner with multiple lenders to offer a variety of financing packages. This flexibility can cater to customers with different credit profiles and financial capabilities.

- Transparent Communication: Clearly explain the terms, benefits, and obligations of each financing option. Transparency builds trust and helps customers make informed decisions.

3. Leverage Technology for Streamlined Financing Processes

Technology can play a pivotal role in enhancing your dealership’s financing processes. By adopting digital tools and platforms, you can streamline operations, reduce paperwork, and improve efficiency.

Key Strategies:

- Online Financing Applications: Offer online application forms that customers can complete at their convenience. This speeds up the approval process and provides a seamless experience.

- Integrated CRM Systems: Utilize Customer Relationship Management (CRM) systems to track customer interactions, manage leads, and follow up on financing inquiries. A well-organized CRM can improve communication and conversion rates.

- Data Analytics: Use data analytics to gain insights into customer behavior and financing trends. This information can help you refine your financing strategies and target the right audience.

4. Build Strong Relationships with Lenders

Having a robust network of reliable lenders is crucial for securing competitive financing deals. Building and maintaining strong relationships with these financial institutions can provide your dealership with better financing options and faster approvals.

Key Strategies:

- Regular Communication: Maintain open lines of communication with your lender partners. Regular meetings and updates can help you stay informed about new products and policies.

- Performance Tracking: Keep track of your financing performance and share positive results with your lenders. Demonstrating your dealership’s success in securing financed deals can strengthen your partnerships.

- Collaborative Initiatives: Collaborate with lenders on marketing campaigns and customer outreach programs. Joint efforts can enhance visibility and attract more financing opportunities.

Securing more financing deals in the automotive industry requires a combination of education, personalized service, technology, and strong lender relationships. By implementing these strategies, your dealership can improve its financing processes, enhance customer satisfaction, and ultimately drive more sales. Remember, a well-informed and empowered sales team, coupled with a customer-centric approach, can significantly boost your dealership’s success in financing deals.

Summer is the perfect time for road trips and adventures. As the weather warms up, many people hit the road to explore new destinations or visit favorite spots. However, before you embark on your summer journey, it’s crucial to ensure your vehicle is in top condition. Preparing your car for the summer heat not only helps prevent breakdowns but also ensures a safe and enjoyable trip. Here’s a guide to getting your car ready for summer adventures, including the benefits of having an extended warranty.

1. Check Your Cooling System

One of the most critical components of your car during the summer is the cooling system. High temperatures can cause your engine to overheat, leading to severe damage. Make sure to:

- Inspect the radiator and hoses: Look for any signs of wear, cracks, or leaks.

- Check coolant levels: Ensure the coolant is at the appropriate level and consider flushing the system if it’s been a while since the last service.

- Test the thermostat: A malfunctioning thermostat can cause overheating issues.

An extended warranty can cover the cost of repairs for issues related to the cooling system depending on your coverage, providing peace of mind during your travels.

2. Air Conditioning Check

A functioning air conditioning system is a must during the hot summer months. Not only does it keep you comfortable, but it also helps prevent driver fatigue. Have a professional inspect the system to ensure it’s working correctly. This includes checking:

- Refrigerant levels: Low refrigerant can reduce the effectiveness of the AC.

- Compressor and other components: Ensure they are functioning properly.

If your vehicle’s AC system needs repairs, an extended warranty can help cover the costs depending on your policy, saving you from unexpected expenses.

3. Tire Inspection and Maintenance

Proper tire maintenance is crucial for safety and fuel efficiency. Before heading out on your summer road trip, make sure to:

- Check tire pressure: Under-inflated tires can lead to poor handling and increased fuel consumption.

- Inspect tire tread: Worn tires can be dangerous, especially in wet conditions.

- Rotate tires if needed: This helps ensure even wear and extends the life of your tires.

Having an extended warranty may provide coverage for tire-related issues, including replacement if necessary.

4. Battery Check

Summer heat can be tough on your car battery. Extreme temperatures can cause battery fluid to evaporate, leading to decreased performance. To avoid a dead battery on your trip:

- Check the battery terminals for corrosion: Clean them if necessary.

- Test the battery’s charge: If your battery is more than three years old, consider replacing it.

An extended warranty may cover the cost of a new battery if yours fails, ensuring you’re not stranded during your adventure.

5. Brake System Inspection

A properly functioning brake system is essential for safety. Have a professional check your brakes, including:

- Brake pads and rotors: Look for wear and tear.

- Brake fluid: Ensure it’s at the proper level and free of contaminants.

If your brakes need servicing, an extended warranty can help cover the repair costs, giving you peace of mind on the road.

6. Fluid Levels and Oil Change

Ensure all your vehicle’s fluids are at the correct levels, including:

- Engine oil

- Transmission fluid

- Brake fluid

- Power steering fluid

An oil change is particularly important before a long trip, as it keeps your engine running smoothly. An extended warranty can sometimes cover the cost of fluid top-offs and changes as part of your vehicle’s maintenance plan.

7. Emergency Kit

Finally, always carry an emergency kit in your vehicle. It should include items like:

- First aid supplies

- Jumper cables

- Flashlight

- Basic tools

- Water and snacks

In conclusion, preparing your car for summer adventures involves several key maintenance tasks. An extended warranty from Prosidium Warranty and Capital can provide financial protection against unexpected repairs, allowing you to enjoy your trip with confidence. Regular maintenance and having the right warranty coverage ensure that your summer journeys are safe, fun, and stress-free.

Brake fluid is a crucial component of your vehicle’s braking system, playing a vital role in ensuring your car stops effectively. Despite its importance, brake fluid is often overlooked in routine vehicle maintenance. Regularly changing your brake fluid is essential for several reasons, all of which contribute to your safety on the road.

1. Maintaining Optimal Braking Performance

Brake fluid is responsible for transmitting the force from your brake pedal to the brake components at each wheel. Over time, brake fluid can absorb moisture from the air, leading to a reduction in its boiling point. When the brake fluid’s boiling point decreases, it becomes less effective at transferring force, resulting in a spongy brake pedal feel and reduced braking performance. Regularly changing the brake fluid helps maintain its effectiveness, ensuring that your brakes respond quickly and reliably when you need them most.

2. Preventing Brake System Corrosion

Moisture absorption isn’t just detrimental to brake fluid performance; it can also cause internal corrosion in the braking system. Water-contaminated brake fluid can lead to rust and corrosion in metal components, such as brake lines, calipers, and master cylinders. This corrosion can weaken these components, potentially leading to leaks or failure. By regularly replacing brake fluid, you can minimize the risk of corrosion and extend the lifespan of your braking system.

3. Avoiding Brake Fade in High-Stress Situations

Brake fade occurs when the braking system overheats, causing a loss of braking power. This can happen during intense braking situations, such as driving down a steep hill or during a high-speed stop. Old or degraded brake fluid with a low boiling point can contribute to brake fade, as it may vaporize under high temperatures, creating air bubbles in the brake lines. These air bubbles reduce the fluid’s ability to transmit force, making it harder to stop the vehicle. Fresh brake fluid with a high boiling point helps prevent brake fade and ensures your brakes perform reliably under stress.

4. Enhancing Overall Vehicle Safety

A well-maintained braking system is essential for safe driving. Ineffective brakes can increase stopping distances and the likelihood of accidents. Regular brake fluid changes are a simple yet crucial aspect of vehicle maintenance that can significantly enhance overall safety. Ensuring that your brake fluid is in good condition means that your vehicle can stop quickly and effectively, reducing the risk of collisions.

5. Following Manufacturer Recommendations

Vehicle manufacturers provide specific recommendations for brake fluid maintenance, including the type of brake fluid to use and the interval for changing it. These recommendations are based on extensive testing and are designed to keep your braking system in optimal condition. Ignoring these guidelines can lead to decreased performance and increased risk of brake system failure.

In conclusion, regular brake fluid changes are a vital part of maintaining your vehicle’s braking system and ensuring your safety on the road. By following your vehicle manufacturer’s maintenance schedule and changing your brake fluid as recommended, you can maintain optimal braking performance, prevent system corrosion, and enhance overall vehicle safety. Don’t overlook this critical aspect of vehicle maintenance—your safety depends on it.

The car industry is changing fast, and some exciting things are happening! Here’s what you can expect in the future:

1. More Electric Cars: Electric cars are becoming more popular. They run on batteries instead of gas, which is better for the environment. Companies like Tesla are leading the way, and soon, we might see more electric cars than gas ones.

2. Self-Driving Cars: Imagine sitting in a car that drives itself! Self-driving cars are being tested right now, and are actually already on the road in cities like Scottsdale, Arizona. These cars use sensors and cameras to navigate, making driving safer and easier.

3. Smart Cars: Cars are getting smarter. Many, if not all, new cars have features like GPS, internet connectivity, and even voice control. You can talk to your car and ask it to play music, find directions, or even call someone.

4. Better Fuel Efficiency: Even gas cars are getting better. They are being designed to use less fuel, which saves money and helps the environment. This means you can drive farther without spending as much on gas.

5. New Car Designs: Cars are becoming more efficient, stylish, and comfortable. Expect to see sleek designs, high-tech interiors, and more customization options.

How This Might Change Limited Warranties

With all these new changes, vehicle service contracts will also need to adapt. Here’s how:

1. Longer Battery Limited Warranties: As more electric cars hit the road, limited warranties will need to cover the batteries, which can be expensive to replace. Expect longer battery limited warranties to give buyers peace of mind.

2. Software Updates: Smart cars and self-driving cars rely on software. Limited warranties might start to include software updates and fixes, ensuring your car’s tech stays up-to-date and runs smoothly.

3. Comprehensive Coverage: With advanced technology and smart features, cars will need more comprehensive vehicle service contracts that cover both traditional car parts and new tech components like sensors and cameras.

4. Customizable Vehicle Service Contracts: Just like cars, limited warranties might become more customizable. Buyers could choose plans that fit their specific needs, whether it’s extended coverage for electric batteries or protection for high-tech features.

In short, as cars get smarter, safer, and more efficient, limited warranties will evolve to match these advancements, offering better protection and peace of mind for car owners. So, buckle up and get ready for an exciting ride into the future of the car industry!

As an F&I manager or sales professional in the automotive industry, continuous growth and skill enhancement are crucial for staying competitive and maximizing your earnings. The Prosidium Performance Center offers a comprehensive Pro F&I Certification Course designed to equip you with the skills and knowledge needed to excel in your role. Here’s why you should consider signing up for this transformative program.

Comprehensive Learning Experience

The Pro F&I Certification Course at Prosidium Performance Center is crafted to provide a thorough understanding of F&I processes and best practices. The program covers essential topics such as:

- Building Value in Products: Learn how to effectively communicate the value of various F&I products to your customers.

- Increasing Products per Vehicle: Develop strategies to upsell additional products, thereby increasing profitability.

- Enhancing Profitability: Master techniques to maximize your profit margins on every sale, ensuring both customer satisfaction and business success.

Expert-Led Training

The course is led by seasoned professionals with extensive experience in the automotive F&I industry. Their insights and real-world examples provide practical knowledge that you can apply immediately in your dealership. By learning from the best, you can gain a competitive edge and improve your performance significantly.

State-of-the-Art Facilities

Training at the Prosidium Performance Center means you get access to state-of-the-art facilities designed to enhance your learning experience. From smart boards to interactive training sessions, every aspect of the course is designed to provide a conducive learning environment. Additionally, amenities such as group dinners and easy hotel bookings ensure a comfortable and engaging experience throughout the program.

Networking Opportunities

The Pro F&I Certification Course is also a great opportunity to network with other professionals in the industry. Sharing experiences and strategies with peers can provide new insights and foster professional relationships that benefit your career in the long run.

Proven Results

Participants of the Prosidium Performance Center’s programs often report significant improvements in their performance metrics. Increased customer satisfaction index (CSI) scores and higher profitability are common outcomes for those who complete the certification. This is a testament to the quality and effectiveness of the training provided.

Support Beyond the Classroom

Prosidium Performance Center doesn’t just stop at training; they offer continued support even after you complete the course. Trainers check in about 30 days post-completion to ensure you’re implementing what you’ve learned effectively and to offer additional guidance if needed.

Why Choose Prosidium Performance Center?

- Ethical and Compliant Training: The training programs are built on strong ethical and compliance principles, ensuring that you not only improve your sales but also build trust with your customers.

- Experienced Instructors: Learn from the industry’s best, with trainers who have decades of experience and a track record of success.

- Comprehensive Curriculum: Covering all aspects of F&I management, from sales techniques to customer service, the curriculum is designed to make you a top-performing F&I manager.

If you’re ready to take your career to the next level, consider enrolling in the Pro F&I Certification Course at the Prosidium Performance Center. Our next course begins on October 15th and you won’t want to miss it! You can register here!

Enhance your skills, boost your sales, and achieve greater success in your career with Prosidium Performance Center’s Pro F&I Certification Course!

Keeping up with regular maintenance is essential for your vehicle’s performance and your ability to make limited warranty or vehicle service contract claims. Here’s why regular maintenance matters and how it impacts your claims.

Why Regular Maintenance Matters

Preventing Major Repairs

Regular maintenance, like oil changes and brake inspections, helps prevent major and costly repairs. When you follow a maintenance schedule, your car is less likely to break down, which is crucial since many limited warranties and vehicle service contracts won’t cover damage caused by neglect.

Maintaining Limited Warranty Validity

To make a successful limited warranty claim, you usually need to prove you’ve followed the manufacturer’s recommended maintenance schedule. This shows you’ve taken care of your vehicle and any issues aren’t due to neglect. Without proof of regular maintenance, your claim could be denied.

Improving Resale Value

Regular maintenance also boosts your car’s resale value. A well-maintained car with a complete service history is more attractive to buyers. Plus, if your car is still under a limited warranty or vehicle service contract, having proof of maintenance can increase its appeal and value.

Keeping Your Maintenance Records Up to Date

Use a Maintenance Log

Keep a log of all maintenance activities, including dates, types of service, mileage, and service provider details.

Save Receipts and Invoices

Always save receipts and invoices from your service provider. These documents are proof of maintenance and are essential for claims. Organize them by date and type of service for easy reference.

Follow the Manufacturer’s Schedule

Stick to the maintenance schedule in your vehicle’s owner’s manual. This schedule is designed to keep your vehicle in top condition and is often required to maintain your limited warranty or vehicle service contract.

Choosing Professional Service Providers

Pick a reputable service provider for your vehicle maintenance. Certified mechanics and authorized service centers understand the specific needs of different vehicle brands and can ensure maintenance is done correctly. Service by certified professionals is more likely to be accepted by your limited warranty or vehicle service contract.

Regular maintenance is vital for keeping your vehicle in great shape and ensuring your limited warranty claims are successful. By following a maintenance schedule, keeping detailed records, and choosing reputable service providers, you protect your investment and gain peace of mind knowing your vehicle is covered under your service contract.

A well-maintained vehicle is not just reliable but also a reflection of your commitment to its care. For more tips on vehicle maintenance and limited warranty options, visit Prosidium USA today.

Limited warranties can be a lifesaver when unexpected repairs arise, but many car owners don’t fully understand how to make the most of their coverage. Here are some tips and tricks to help you maximize your limited warranty and ensure you get the best value.

1. Understand Your Limited Warranty Coverage

The first step in maximizing your limited warranty is understanding exactly what it covers. Limited warranties typically come in three main types:

- Bumper-to-Bumper: Covers almost all parts of the vehicle except for wear-and-tear items like tires and brake pads.

- Powertrain: Focuses on the engine, transmission, and other parts that make the car move.

- Extended: An optional coverage you can purchase to extend the protection beyond the original warranty period.

Read your limited warranty documentation carefully to know what is covered and what is not. This will help you avoid unexpected expenses and make informed decisions about repairs.

2. Follow the Maintenance Schedule

One of the most important aspects of maintaining your vehicle service contract coverage is adhering to the manufacturer’s recommended maintenance schedule. Regular maintenance not only keeps your vehicle running smoothly but also ensures that you remain eligible for vehicle service contract repairs. Skipping scheduled maintenance can void your vehicle service contract, leaving you to pay for repairs out of pocket.

3. Keep Detailed Records

Maintaining detailed records of all maintenance and repair work is crucial. This documentation serves as proof that you have followed the maintenance schedule and can be used to support vehicle service contract claims. Keep receipts, work orders, and any other relevant paperwork organized and easily accessible.

4. Handle Repairs Promptly

If you notice a problem with your vehicle, don’t wait to have it checked out. Small issues can quickly escalate into major repairs if left unattended. Addressing problems early can often lead to quicker, less expensive fixes and ensure that the repairs are covered under your vehicle service contract.

5. Choose Authorized Repair Shops

While the Magnuson-Moss Warranty Act allows you to use any repair shop, choosing an authorized service center can streamline the vehicle service contract claims process. Authorized shops are familiar with vehicle service contract work and can often handle the paperwork and approvals directly with the manufacturer, saving you time and hassle.

6. Be Aware of Exclusions

Every vehicle service contract has exclusions—items and conditions that are not covered. Common exclusions include routine maintenance items, wear-and-tear parts, and damage from accidents or misuse. Understanding these exclusions will help you avoid unnecessary disputes and focus on getting the most out of your coverage.

7. Consider an Extended Warranty

If your vehicle’s original limited warranty is about to expire, consider purchasing an extended warranty. Extended warranties can provide additional peace of mind and financial protection as your car ages and becomes more prone to mechanical issues. Be sure to compare different plans and read the fine print to choose the best option for your needs.

8. Stay Informed About Recalls

Manufacturers occasionally issue recalls for defective parts or safety issues. Repairs for recalled items are typically free, even if your vehicle service contract has expired. Stay informed about recalls by checking the National Highway Traffic Safety Administration (NHTSA) website or signing up for alerts from your car’s manufacturer.

Maximizing your limited warranty coverage requires a proactive approach. By understanding your vehicle service contract, keeping up with maintenance, and handling repairs promptly, you can ensure that you get the most value and protection from your vehicle service contract. Remember, a well-maintained vehicle not only runs better but also retains its value longer, making these efforts worthwhile in the long run.

Hey, auto industry finance professionals! The Finance and Insurance (F&I) office is evolving, and staying on top of the latest trends can help you excel. Let’s dive into the key trends shaping the F&I landscape and how you can use them to boost warranty product sales and enhance customer satisfaction.

1. Digital Transformation and Online Sales

The digital age has revolutionized the automotive industry, and the F&I office is no exception. More customers are researching and buying cars online, changing how we approach selling warranty products.

Implications for you: Adapt to the digital landscape by offering online F&I product presentations and consultations. Use digital tools to provide detailed information about warranty products, financing options, and other add-ons.

Tips for success:

- Embrace e-contracting: Streamline paperwork with electronic contracting solutions to speed up transactions and improve the customer experience.

- Virtual consultations: Offer video calls to discuss warranty products with customers, providing real-time answers and personalized service.

2. Personalization and Data-Driven Sales

Customers expect personalized experiences, and using data can help you tailor your offerings to meet their needs.

Implications for you: Use customer data to understand preferences and buying behaviors. This allows you to recommend the most relevant warranty products and F&I services.

Tips for success:

- CRM systems: Utilize Customer Relationship Management systems to gather and analyze customer data, helping you identify the best products for each individual.

- Customized presentations: Personalize your sales pitch based on the customer’s vehicle, driving habits, and purchase history. Highlight how specific warranty products can offer peace of mind and financial protection.

3. Transparency and Education

Today’s consumers are informed and expect transparency. Providing clear and honest information about F&I products is crucial.

Implications for you: Focus on educating customers about the value and benefits of warranty products. Build trust through transparency about costs, coverage, and exclusions.

Tips for success:

- Educational materials: Create brochures, videos, and other resources that clearly explain the benefits of warranty products. Make these available both online and in your dealership.

- Transparent pricing: Be upfront about pricing and terms. Use comparison charts to help customers understand their options.

4. Compliance and Regulatory Changes

The F&I office must stay compliant with evolving regulations to avoid legal issues and maintain customer trust.

Implications for you: Staying updated on regulatory changes is essential. Ensure all sales practices comply with federal and state laws.

Tips for success:

- Continuous training: Participate in regular training on compliance and ethical sales practices. Stay informed about new regulations affecting F&I transactions. The good news is continuing education is made easy through Prosidium Performance Center. We offer a highly sought-after PRO F&I Course that will teach old and new F&I professionals how to put the most money into their family’s pocket.

- Documentation: Maintain accurate and thorough documentation for all transactions. Ensure customers receive and understand necessary disclosures.

5. Enhanced Customer Experience

Providing an exceptional customer experience can set your dealership apart and increase F&I product sales.

Implications for you: Focus on creating a seamless and positive experience from the moment customers enter the dealership to the completion of their purchase.

Tips for success:

- Customer feedback: Regularly collect and analyze customer feedback to identify areas for improvement. Use this feedback to enhance your sales process and interactions.

- Value-added services: Offer additional services like complimentary vehicle inspections or extended service hours to enhance the customer experience and build loyalty.

Leveraging PWC’s Warranty Products

Staying ahead of these trends will help you enhance your F&I sales strategy and provide better service. PWC’s vehicle warranty products are designed to offer comprehensive coverage and alleviate high maintenance costs. Educating your customers about these products can help them make informed decisions and provide them with peace of mind.

By incorporating these trends into your daily practice, you’ll be well-equipped to meet the evolving needs of your customers. Stay proactive, informed, and continue to deliver exceptional service.

Let’s talk about something that all of us have faced at one point or another – those pesky warning lights on your car’s dashboard. You know the ones I’m talking about. They pop up unexpectedly and often leave you wondering, “Is it really that serious?” Well, buckle up because we’re going to dive into why you should never ignore those warning lights.

Your Car’s Way of Saying “Help!”

First things first, think of your car’s warning lights as its way of communicating with you. These lights are like your car’s language, telling you that something needs attention. It’s like when you get a headache; it’s your body’s way of saying, “Hey, something’s not right here!” Ignoring your car’s warning lights is like ignoring your body’s signals – not a great idea.

The Most Common Warning Lights

Let’s break down some of the most common warning lights you might see:

- Check Engine Light: This one’s a biggie. It can mean a lot of things, from a loose gas cap to something more serious like a misfiring engine. Don’t panic, but don’t ignore it either. It’s worth getting it checked out.

- Oil Pressure Warning: If this light comes on, it means your car’s oil pressure is low. Driving with low oil pressure can seriously damage your engine, so this is one to address immediately.

- Brake Warning: Your brakes are kind of important, right? This light could mean low brake fluid, worn brake pads, or something more serious. Don’t risk it – get your brakes checked.

- Battery Alert: This light means your battery isn’t charging properly. It could be a faulty alternator or a dying battery. Either way, you don’t want to end up stranded with a dead battery.

- Tire Pressure Warning: Modern cars have sensors to monitor tire pressure. If this light comes on, it means one or more of your tires is under-inflated, which can affect your car’s handling and fuel efficiency.

What’s the Worst That Could Happen?

Now, you might be thinking, “Okay, but what’s the worst that could happen if I ignore a warning light for a little while?” Here’s the thing – ignoring these lights can lead to bigger problems down the road (pun intended).

- Increased Repair Costs: What might start as a small issue can turn into a major repair if ignored. For example, ignoring a check engine light might lead to costly repairs that could have been avoided with early intervention.

- Safety Risks: Some warning lights, like the brake or tire pressure warnings, are directly related to your safety. Ignoring them puts you and others on the road at risk.

- Lower Resale Value: If you plan to sell your car in the future, a history of ignored warning lights and deferred maintenance can significantly lower its resale value.

What to Do When a Warning Light Comes On

So, what should you do when a warning light comes on? Here’s a simple plan of action:

- Don’t Panic: Not all warning lights mean immediate disaster. Stay calm and assess the situation.

- Check Your Manual: Your car’s manual can give you specific information about what each warning light means and what steps to take.

- Address It Promptly: Even if the issue seems minor, it’s best to address it sooner rather than later. This can prevent further damage and save you money in the long run.

- Seek Professional Help: If you’re unsure about what a warning light means or how to fix it, take your car to a professional. They have the tools and expertise to diagnose and fix the problem.

Regular Maintenance is Key

One of the best ways to avoid seeing those warning lights is to keep up with regular maintenance. Regular oil changes, tire rotations, and brake inspections can help keep your car in tip-top shape and reduce the chances of unexpected issues.

In the end, those warning lights are there for a reason. They’re your car’s way of saying, “Hey, I need a little attention here!” Ignoring them can lead to bigger problems, higher repair costs, and even safety risks. So, the next time you see a warning light pop up on your dashboard, take it seriously. Your car (and your wallet) will thank you. And here’s the good news: PWC’s vehicle warranty products can help alleviate those high-cost maintenance fees. With our comprehensive coverage, you can address issues promptly without breaking the bank. Our warranties ensure that you’re protected from the financial burden of unexpected repairs, giving you peace of mind and keeping your car in top shape.

In today’s fast-paced world, owning a vehicle is both a necessity and an investment. Whether you’re driving a brand-new model off the lot or cruising in a trusty pre-owned gem, ensuring your vehicle’s longevity and performance is paramount. That’s where Prosidium Warranty & Capital’s Auto Care steps in, offering a comprehensive vehicle service contract that delivers unparalleled peace of mind for drivers everywhere.

At Prosidium, we understand that every vehicle and every driver is unique. That’s why our Auto Care plans are designed to cater to a wide range of needs, providing customizable coverage options that suit your lifestyle and budget. From basic Powertrain protection to Maximum exclusionary coverage, we have you covered. Our contracts cover all major vehicle components, such as the engine, transmission, drive axle, seals and gaskets, air conditioning, heating and cooling, electrical systems, braking, suspension, steering, fuel delivery, and much more. Depending on the coverage selected during your vehicle purchase, you can have confidence knowing that the most critical parts of your vehicle are protected.

One of the standout features of Prosidium Auto Care is our commitment to convenience and support. With a low deductible and 24-hour roadside assistance included in every plan, help is always just a phone call away. Whether you find yourself stranded with a flat tire or in need of emergency gas delivery, our roadside assistance team is here to get you back on the road swiftly and safely.

But that’s not all – Prosidium Auto Care goes above and beyond by offering unique benefits that set us apart from the competition. Our plans can be tailored to include a 2 year/30,000 mile maintenance package, ensuring that your vehicle stays in peak condition for years to come.

In addition to our standard benefits, Prosidium Auto Care offers a range of optional add-ons to further enhance your coverage. From deductible discounts for returning to the selling dealer for covered repairs to trip interruption services and business use options, we’ve thought of everything to keep you protected on the road.

And for those with unique vehicle needs, Prosidium Auto Care has you covered. With hybrid and lift kit options available, our plans can be tailored to accommodate a variety of vehicles and lifestyles.

In conclusion, Prosidium Auto Care is more than just a vehicle service contract – it’s your ultimate protection solution. With comprehensive coverage, unbeatable benefits, and a commitment to customer satisfaction, Prosidium Auto Care is the partner you can trust to keep you and your vehicle safe on every journey. So why wait? Take the first step towards worry-free driving today with Prosidium Auto Care.

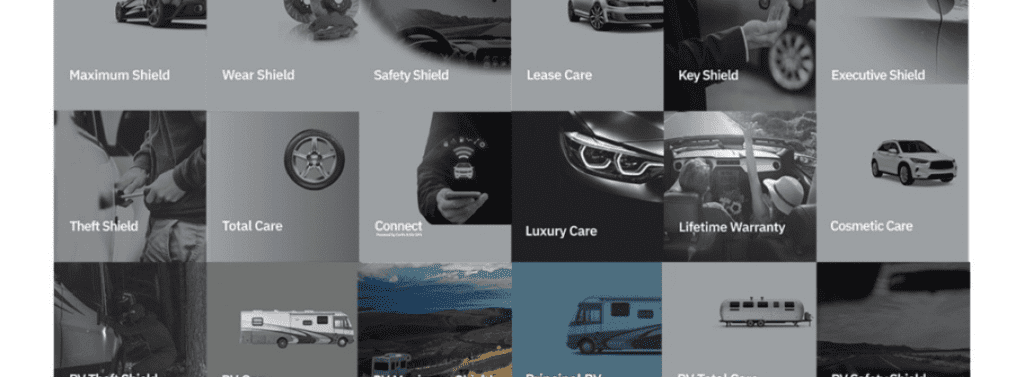

In today’s competitive automotive market, finding the right partner can make all the difference in dealership success. Since 2009, Prosidium Warranty & Capital (PWC) has been the trusted ally for dealerships, offering a comprehensive range of F&I products and services designed to fuel growth and prosperity.

1. Strong Foundation for Success

At Prosidium Warranty & Capital, we believe that success begins with a solid foundation. Our extensive suite of F&I products includes Vehicle Service Contracts, Limited and Lifetime Warranty Programs, Guaranteed Asset Protection, and Ancillary Protection Products like Anti-Theft and Key Replacement. These products are backed by A.M. Best ‘A’ rated carriers, ensuring customers’ peace of mind.

In addition to our product offerings, we provide robust training, development, and participation programs for dealers and agents. Our aim is to empower our partners with the knowledge and tools needed to excel in today’s competitive market.

2. Cutting-Edge Technology for Seamless Operations

Innovation is key at Prosidium Warranty & Capital. Our online Prosidium Contract Administration program leverages state-of-the-art technology for E-Rating, E-Contracting, E-Remitting, claims processing, and reporting. This streamlined “One Source” solution simplifies processes for dealers and customers alike.

Moreover, our integration with dealer DMS and menu systems ensures a seamless end-to-end experience. With Prosidium, dealers can focus on sales while we handle the administrative tasks efficiently.

3. Industry-Leading Excellence

At Prosidium Warranty & Capital, we are committed to excellence in all aspects of our operations. From superior products to cutting-edge technologies and comprehensive training programs, we strive to deliver top-tier service to our partners.

Drawing on our team’s extensive experience in marketing F&I products and previous retail franchise ownership, we offer unique business opportunities for agents and dealers alike. Our innovative approach opens up new revenue streams, driving growth and success for our partners.

In summary, Prosidium Warranty & Capital is more than just an F&I provider – we’re a trusted partner dedicated to helping dealerships thrive. With a strong foundation, advanced technology, and a commitment to excellence, we’re poised to elevate your dealership to new heights. Contact us today to discover how we can help you achieve your growth goals.

Our claims administration and reinsurance programs help minimize risk, while adding additional revenue streams. Contact us to learn more about PWC’s Processes, Products, and Profit Strategies by clicking the button below:

Buying a car can feel like a wild ride, with tons of options, deals, and paperwork to sort through. But did you know that there’s a crucial step that often gets overlooked? It’s called financing and insurance (F&I), and it’s where the real magic happens behind the scenes.

Meet the F&I managers, the unsung heroes of the car-buying process. These folks work tirelessly to make sure you not only get the best financing options but also the right insurance coverage for your needs.

Here’s how these F&I pros have got your back:

Financial Wizards: F&I managers know the ins and outs of automotive financing like the back of their hand. They’ll walk you through all the loan jargon, interest rates, and payment plans, so you can make smart decisions that fit your budget.

Tailored Solutions: No two buyers are the same, and F&I managers get that. They’ll customize their approach to fit your unique needs, whether that means haggling for better loan terms or finding the perfect insurance policy.

Clear Communication: F&I managers believe in transparency. They’ll break down the financing and insurance process in plain language, so you know exactly what you’re signing up for.

Risk Management: Owning a car comes with its fair share of risks, but F&I managers have your back. They’ll offer you options like service contracts and gap insurance to keep you protected from unexpected surprises.

Your Advocate: Think of F&I managers as your personal cheerleaders throughout the car-buying journey. They’re there to answer questions, address concerns, and make sure you feel supported every step of the way.

In a nutshell, F&I managers are like your guardian angels in the world of car buying, dedicated to making sure you have a smooth and satisfying experience. And at Prosidium Performance Center (PWC), we take their training seriously. Our F&I training courses are designed to equip managers with top-notch skills and knowledge so they can offer you the best service possible. Trust us, when you partner with a PWC-trained F&I manager, you’re in good hands. Ready to take the wheel? Sign up for our next class at the link below! https://www.prosidiumperformancecenter.com/

Understanding Vehicle Service Contracts: Your Guide to Vehicle Protection

In the realm of automotive services and products, understanding Vehicle Service Contracts (VSCs) can make a significant difference. Whether you’re seeking extended coverage as a car shopper or aiming to add value as a dealership, navigating VSC coverage should not be confusing. However, there are things to consider that both shoppers and dealers should avoid to provide peace of mind. Let’s explore the top five points of confusion and how Prosidium Warranty & Capital stands out as the ultimate solution for car warranty products.

1. Not knowing or reading the service agreement

A crucial mistake is neglecting to review the terms and conditions of a VSC thoroughly. It’s important to understand what’s covered, the duration of coverage, and any exclusions. Prosidium Warranty & Capital prides itself on transparency, ensuring you understand every aspect of your coverage. When considering a VSC, be thorough in presenting your car buyer with the details of coverages if asked. As a car buyer be sure to be knowledgeable in what is covered or excluded in your coverage to avoid frustration in the future.

2. Ignoring Reputation and Reliability

The reputation of the VSC provider matters. Researching credibility and track record is key to ensuring quality service. Prosidium Warranty & Capital has a stellar reputation for prompt claims processing and reliability, offering peace of mind to customers and sellers alike. We offer 15 second hold times to make sure the people repairing your car get quick approvals from us and that car owners get quick answers directly from US based PWC staff.

3. Skipping Comparison Shopping

Don’t settle for the first option without comparing. Prosidium Warranty & Capital provides competitive pricing and comprehensive coverage options, ensuring you get the best value for your investment.

4. Understanding Terms

VSCs can come in several different term options depending on your vehicle and other factors. Maximum coverage for the longest amount of time or miles can cost more than an option that has shorter mile or year caps. Consider what is important to you as a driver and what is affordable. Prosidium Warranty & Capital offers flexible options, including discounts and customized coverage, catering to your specific needs.

In short, understanding VSC transactions requires diligence, but with Prosidium Warranty & Capital, you can trust that you’re getting the best solution for your car warranty needs. Prioritize thorough research, clear communication, and choose a provider like Prosidium Warranty & Capital for a seamless and beneficial experience.

In the competitive automotive industry, dealerships are constantly seeking innovative solutions to enhance their offerings, improve customer satisfaction, and ultimately drive growth. Prosidium Warranty and Capital emerges as a game-changer in this landscape, offering services designed to support dealerships in achieving their growth objectives. Let’s explore how Prosidium can help your dealership thrive.

1. Comprehensive Warranty Programs

Prosidium understands the importance of providing peace of mind to both dealerships and customers. Their comprehensive warranty products offer extensive coverage options tailored to meet the diverse needs of dealerships and their clients. From powertrain coverage to comprehensive bumper-to-bumper warranties, Prosidium ensures that dealerships can offer compelling warranty packages that enhance the value proposition of their vehicles.

2. Exceptional Customer Service

Prosidium is committed to providing exceptional customer service every step of the way. From assisting dealerships in selecting the right warranty programs to providing ongoing support for claims processing and customer inquiries, Prosidium’s dedicated team ensures that dealerships receive the support they need to deliver a superior customer experience. With prompt response times and personalized attention, Prosidium sets the standard for customer service excellence in the industry.

3. Streamlined Claims Processing

Efficient claims processing is essential for minimizing downtime and maximizing customer satisfaction. Prosidium leverages advanced technology and streamlined processes to ensure fast and hassle-free claims processing for dealerships and their customers. With Prosidium’s efficient claims processing system, dealerships can focus on serving their customers while leaving the complexities of claims administration in capable hands.

4. Customized Solutions for Growth

Prosidium recognizes that every dealership is unique, with its own set of challenges and growth objectives. That’s why they offer customized solutions tailored to the specific needs and goals of each dealership they serve. Whether it’s developing custom warranty programs, designing flexible financing solutions, or providing targeted training and support, Prosidium works closely with dealerships to develop strategies that drive growth and success.

5. Cutting Edge Technology

Prosidium Warranty and Capital is also at the forefront of technological progress in the automotive industry. Leveraging cutting-edge technology, Prosidium continuously innovates its processes and offerings to stay ahead of the curve. From advanced data analytics for personalized customer experiences to seamless integration with dealership management systems for streamlined operations, Prosidium harnesses the power of technology to drive efficiency, enhance decision-making, and deliver unparalleled value to dealerships and their customers. By embracing technology as a catalyst for progress, Prosidium ensures that dealerships partnering with them are well-positioned to thrive in an increasingly digital and competitive landscape, setting the standard for innovation and excellence in the automotive warranty and financing sector.

In conclusion, Prosidium Warranty and Capital is a valuable partner for dealerships looking to grow and thrive in today’s competitive automotive market. With comprehensive warranty programs, exceptional customer service, streamlined claims processing, and customized growth solutions, Prosidium empowers dealerships to reach new heights of success. By partnering with Prosidium, dealerships can enhance their offerings, attract more customers, and achieve sustainable growth in the dynamic automotive industry. Contact us today!

Navigating Cybersecurity

Auto dealerships are facing more and more cybersecurity challenges, making the safety of customer information a top priority. Dealerships have a large task at hand: keeping sensitive information safe from hackers who are intent on looking for ways to steal it. With the rise in online threats, dealerships are stepping up their efforts, using tech and implementing regulatory safeguards to prevent sensitive data from falling into the wrong hands.

The Current Cybersecurity Climate

CDK Global’s “The State of Dealership Cybersecurity 2023” found that nearly half the dealerships experienced cyberattacks in 2023, negatively impacting their finances or operations. With the noticeable increase in cyberattacks, more dealerships are taking strides to protect their data, with 53% expressing confidence in their cybersecurity measures, a noticeable rise from the previous year.

Among the safeguards, the Federal Trade Commission’s (FTC) Safeguards Rule includes a heightened focus on consumer data protection. The new rule requires increased data protection measures and calls for quick reporting of data breaches, changing the way dealerships handle cybersecurity for the better.

Rising Pressures and Emerging Threats

Dealerships are dealing with increased liability risks and rising costs of cyber insurance, all while insurance companies are offering less coverage. Erik Nachbahr of Helion Technologies points out the dilemma dealerships face: insurance is costing more but covers less, and dealers must spend more on tech and other steps to stay safe.

Cyber threats, such as phishing, add another layer of complexity. Third-party software is dealing with more scrutiny from dealers due to potential security loopholes that could expose dealers’ primary systems to cyberattacks.

Adapting and Advancing Cybersecurity Measures

Despite these issues, the auto industry is working hard to adapt and improve. Dealerships are taking action in their cybersecurity efforts, recognizing the need to protect against the impacts of cyberattacks. Compliance with regulatory requirements, like the FTC’s Safeguards Rule, has become a focal point for dealers, showing a shift towards stronger cybersecurity measures as the industry evolves digitally.

The Road Ahead

Cybersecurity for auto dealerships in 2024 is still a big challenge, from legal liabilities to the technical complexities of protecting an expanding digital footprint. Initiatives like multifactor authentication and working with tech firms are becoming more common, reflecting a comprehensive and proactive approach to cybersecurity that covers both prevention and response strategies.

As dealerships work through the complexities of cybersecurity, keeping customer data safe, adhering to regulatory requirements, and adopting security measures are key. The journey is ongoing, but with vigilance and innovation, dealerships can aim to stay ahead of cyber threats, keeping dealerships and their customers safe.

Navigating the complexities of Finance & Insurance (F&I) coverage is key when looking to protect a vehicle investment, be it a car or a recreational vehicle (RV). Given the financial commitments involved, grasping how coverage needs differ between RVs and cars is important. These differences not only reflect the distinct aspects of ownership and usage but also the unique F&I opportunities each type of vehicle presents.

The Basics of Prosidium F&I Coverage

For Auto:

F&I in the automotive sector primarily includes extended warranties, GAP (Guaranteed Asset Protection) insurance, and vehicle service contracts. These products are designed to protect buyers from unforeseen expenses due to repairs, accidents, or the depreciation of the vehicle over time.

For RV:

Coverage for RVs typically includes these same categories of coverage but more comprehensive, reflecting the dual nature of RVs as both vehicles and living spaces. It encompasses protection for the living spaces and addresses the specialized needs of RV living and driving. This broader scope combines elements of vehicle and home coverage to mitigate a wider range of risks. Prosidium’s specific products tailored for RVs include:

RV Total Care: Coverage for costs of repairs due to common road hazards.

RV Maximum Shield: Protection against certain internal/external damages and wear.

RV Safety Shield: Product covering windshield protection and repairs.

RV Theft Shield: Theft protection system guarding against theft and unrecovered total loss of the RV.

Prosidium Care: Specialized mechanical coverage for towable and motor homes.

RV GAP: Covers the gap between the RV’s market value and loan amount in the event of a total loss.

Understanding RV Coverage Variations and Market Dynamics