The auto industry in the United States has been disrupted for three years and is only just now seeing signs of recovery. Several key themes are fueling this year’s recovery. David Phillips of Automotive News delves into some of the top automakers’ third-quarter results. Let’s take a closer look at the third-quarter outcomes and trends that are shaping the automotive world.

Strong Third-Quarter Sales Across the Board

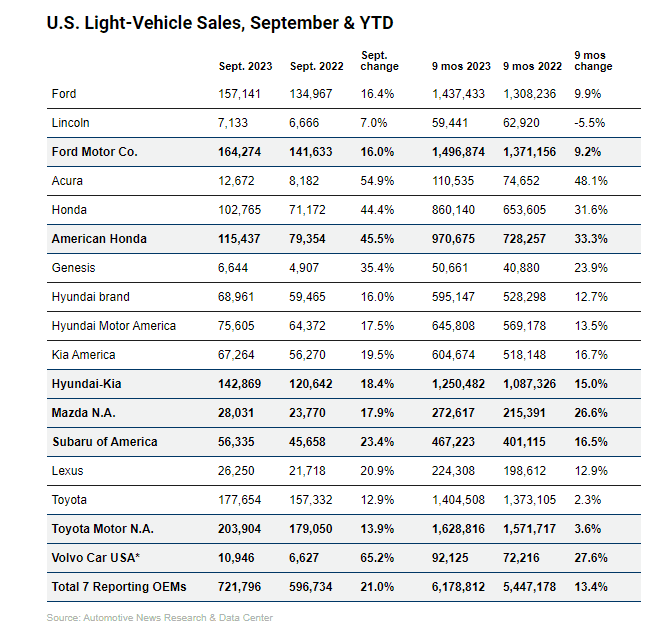

One notable trend is the strong sales performance of automakers in the third quarter. General Motors, Toyota, Honda, Hyundai, Kia, and others have all reported significant sales increases during this period. This combined success is due to better inventory management, higher demand for light vehicles and trucks, increasing fleet shipments, and appealing incentives. Despite challenges like strikes and certain supply constraints, the industry has yet to see severe impacts in its third quarter results.

Steady Restock of Inventories

Many automakers have been slowly replenishing their inventories, which has been critical to their recent sales growth and recovery. Toyota, for example, has had five straight months of gains as their inventory rebounds, while Hyundai has also greatly expanded its inventory and sales. This shows a comeback from the previous year’s supply chain and manufacturing difficulties, when much fewer of these automakers’ vehicles were making it to dealership lots.

Strong Demand for Light Vehicles

Light vehicles, including trucks and electric vehicles, continue to be popular among customers. Amid supply and logistics issues, the demand for light vehicles remains high even with rising interest rates and costs. Automakers have been capitalizing on this by offering a range of light vehicle models to cater to various customer preferences.

High Sales for Best-Selling Models

Several automakers have witnessed large sales gains for their best-selling models. This demonstrates that consumers are still interested in these well-established and trusted vehicles. Some models, such as Honda’s Accord and Civic, have experienced gains of 52 percent or more, reflecting the positive direction automotive sales are moving in after several years of sales challenges.

Year-to-Date Sales Competitions

Competition among automakers is intensifying as U.S. inventory levels recover across most automakers. Kia, for instance, has now outsold Hyundai in five out of nine months this year, leading in year-to-date sales by a notable margin. This competition is a sign of a recovering industry that benefits consumers by granting them more choices and driving innovation.

Third Quarter Industry-Wide Recovery

The U.S. auto market is rebounding after facing some ongoing challenges, including the COVID-19 pandemic, a global microchip shortage, and the recent United Auto Workers (UAW) strike. This recovery is attributed to pent-up consumer demand, higher fleet shipments, and overall resilience in the face of higher vehicle prices and interest rates.

The third quarter results of 2023 have proven automakers to be much more resilient than analysts originally predicted. Between continued year-over-year sales gains, growing new vehicle fleets, and pent-up consumer demand from three years of instability, automakers are seeing promising third-quarter results.